In our previous blog last week, California Proposition 19 Pass Now What?, we shared how Proposition 19, operates. In this blog, we follow up with some helpful examples and illustrations so you can better understand its application and impact.

As a reminder, Proposition 19 is a California ballot measure that modifies Proposition 13 (which limits increases of real property tax to two percent per year unless reassessed due to sale or transfer) and Proposition 58 (which allows property owners to transfer their primary residence to their children at the preferential property tax assessment and up to $1 million of assessed value of other real property, with a later proposition extending the benefit to qualifying grandchildren).

Under Proposition 19, only a primary residence, not other real property, can be transferred to children or qualifying grandchildren at the preferential assessed value. Further, the preferential assessed value is only available if the children or qualifying grandchildren will use the home as their primary residence and to the extent that the fair market value of the residence does not exceed the assessed value by more than $1 million. This part of Proposition 19 takes effect on February 16, 2021 (note that February 15 is President’s Day, when recorder’s offices will be closed).

Here Are Some Examples to Provide Clarity:

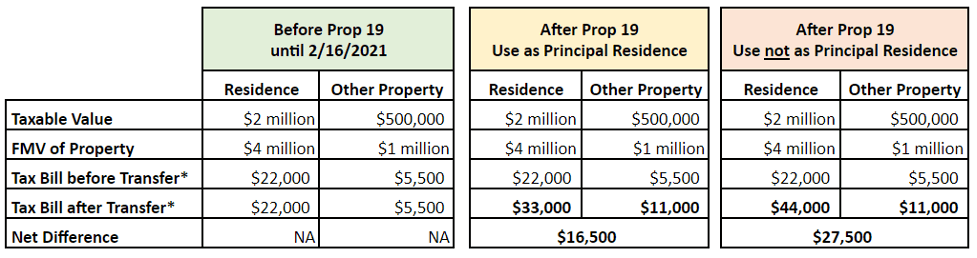

Under current law: Parents seek to give their home and a rental property to their child. The home has a taxable value of $2 million with a property tax bill of $22,000. Today, the home has appreciated, and the value is now $4 million, which means it has increased by $2 million. If the parents gift the home to their child, the taxable value remains $2 million, and the child receives the benefit of continuing to pay only $22,000 on the assessed value (with modest annual increases). The rental property has a taxable value of $500,000, but its FMV is $1 million, with a property tax bill of $5,500. The parents could gift the rental property to their child, and the taxable value of the property would also remain the same at $5,500.

Under Prop 19: Using the same examples, and assuming the child uses the home as the child’s principal residence, only the first $1 million of increased value in the home is exempt. However, the home has increased in value by $2 million, resulting in only $1 million of the increase being excluded from reassessment, or $3 million of assessed value. This would result in a new property tax bill to the child of $33,000. Since there is no longer an exemption for non-principal residences, the rental property is reassessed to FMV of $1 million, resulting in a tax bill to the child of $11,000. Between the two properties, this is a net increase in annual property taxes of $16,500 over the pre-Prop 19 parent-child exclusion.

*1.1% is used for calculating tax bill on taxable value

Proposition 19 also provides benefits for certain homeowners. Under current law, homeowners over fifty-five years old and certain disabled individuals can transfer the taxable value from their current home to a new residence in the same county if the value of the new home is less than or equal to the value of their old home. Proposition 19 allows victims of wildfires and other natural disasters, regardless of their age or disability, to transfer their taxable value to a new home. In addition, homeowners within the preferred classes are no longer limited to purchasing a new home in the same county but can relocate anywhere in the state of California. Also, the value of the new home can be greater than the value of the previous one—though the increase in value must be added to the old home’s transferred assessed value. This change will become effective on April 1, 2021.

Key Takeaways

The passage of Proposition 19 has generated a number of estate planning issues. For example, the changes could affect pre-existing trusts, such as qualified personal residence trusts, which are typically established with the intent of allowing parents to continue to live in the home while passing ownership on to their children. Once Proposition 19 takes effect, the property will be reassessed unless the children are also using it as their primary residence—and even if they are using it as their primary residence, there is a cap of $1 million on the exclusion. Thus, strategies designed to mitigate unfavorable results should be effectuated without delay. However, the benefits of making a lifetime transfer of the property must be weighed against those of a transfer at death, which would enable the children to have a stepped-up basis in the property. Gift and estate tax considerations may also come into play.

If you are interested in determining appropriate solutions and take the next steps quickly, contact us to schedule a meeting today.

Want to Know How Prop 19 Impacts Your Estate Plan?