Retirement is a significant life transition that often prompts individuals to reevaluate their financial plans and priorities. While much attention is rightly placed on retirement savings and investment strategies, equally important is the process of estate planning. As you prepare for retirement, taking proactive steps to organize your estate can provide peace of mind and […]

Living Trusts

Choosing, Reviewing, and Empowering Your Agents

In the realm of estate planning, much attention is often given to drafting wills, establishing trusts, and distributing assets. However, one crucial aspect that deserves equal consideration is the selection and empowerment of agents entrusted with carrying out your wishes when you are unable to do so yourself. These agents play pivotal roles in executing […]

The Importance of Basic Estate Planning for Your 18-Year-Old

As parents, we always strive to protect and provide for our children. As your child reaches the age of 18, you may think that they are officially adults, ready to take on the world. While it’s true that they are becoming more independent, it’s also essential to recognize that certain responsibilities still rest upon your […]

Protecting Your Trust from Scams and Fraud

Trusts are powerful financial tools used to manage and protect assets for individuals and their beneficiaries. They provide a reliable way to safeguard wealth for future generations, manage charitable giving, and protect assets from potential creditors. However, just like any financial arrangement, trusts can become targets for scams and fraud. To ensure your trust remains […]

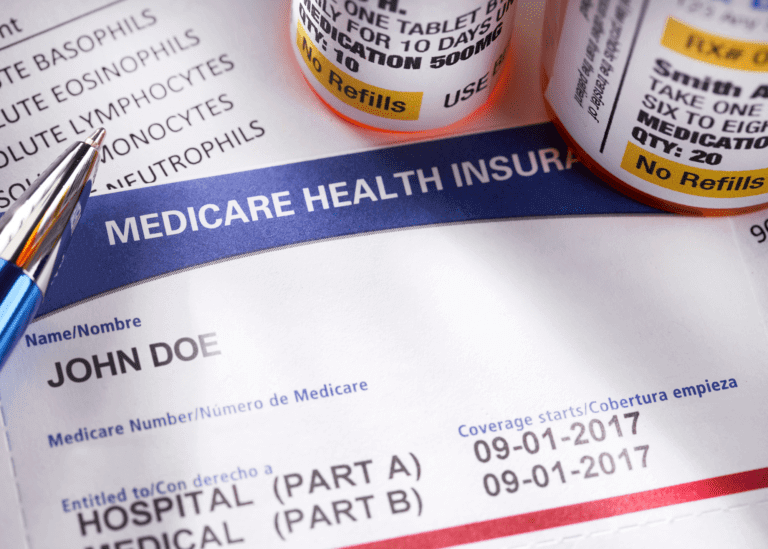

Navigating the Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) is a critical time for Medicare beneficiaries to review and make changes to their healthcare coverage. Whether you’re new to Medicare or have been enrolled for years, understanding the AEP and knowing how to prepare can help you make the best choices for your healthcare needs. What Is the […]

Estate Planning Myths and Misconceptions

Estate planning is a crucial aspect of financial responsibility that often gets overlooked or misunderstood. It’s not just for the wealthy; it’s for everyone who wants to ensure that their assets are distributed according to their wishes after they pass away. Unfortunately, there are several myths and misconceptions surrounding estate planning that can lead to […]

Medicare May Not Be Enough

In the realm of healthcare, one often hears about the importance of insurance coverage, especially Medicare. While Medicare plays a significant role in providing healthcare benefits for older Americans, it’s essential to understand that it doesn’t cover everything.This gap in coverage can be particularly challenging for middle-class citizens who may assume that they’re adequately protected. […]

Preparing for Year-End

As the year is quickly coming to a close, it’s a perfect time to conduct a year-end review of your estate planning documents and strategies. Estate planning ensures that your assets are protected, your loved ones are cared for, and your legacy is secure. Here are the essential steps to prepare for the end of […]

Labor for Your Legacy

In the spirit of Labor Day, we take a moment to honor the tireless efforts, dedication, and sacrifices made by workers everywhere. Labor Day isn’t just about barbecues and parades; it’s a recognition of the grind, the sweat, and the perseverance that’s intrinsic to creating and upholding our society. Similarly, estate planning isn’t merely about […]

The ABCs of Estate Planning

As the back-to-school season rolls around, parents everywhere are busy with preparations – from buying new school supplies to setting up schedules and routines. But amidst the rush of a new academic year, there’s another essential matter that parents should prioritize: estate planning. Just as you prepare your children for a successful school year, it’s […]

Aging Parents: Discussing Estate Planning

As our parents age, one of the essential topics that often goes undiscussed is estate planning. While it may be uncomfortable to broach the subject, having an open and honest conversation with your aging parents about estate planning is crucial to ensure their wishes are respected and their assets are protected. The Importance of Estate […]

Making the Right Choice for Your Estate

When it comes to estate planning, creating a trust can be an excellent way to safeguard your assets and ensure they are distributed according to your wishes. Trusts offer flexibility and control, allowing you to protect your wealth and provide for your loved ones even after you’re gone. Before diving into the world of trusts, […]

Extra Layer of Protection to Your Trust

Trusts have long been recognized as powerful tools for managing and protecting assets, ensuring their seamless transfer across generations. They provide a robust framework that allows individuals to safeguard their wealth and exercise control over its distribution. While trusts offer numerous benefits, some individuals may desire an additional layer of protection and oversight. Enter the […]

Navigating Affairs After a Loved One’s Passing

The loss of a loved one is a challenging and emotional time. Amidst the grieving process, there are practical matters that need attention, especially in relation to your loved one’s estate. Estate planning plays a vital role in ensuring a smooth transition and proper distribution of assets. Here are 10 important steps to take when […]

Estate Planning For Blended Families

Blended families are becoming more and more common. These families often include stepchildren, ex-spouses, and other complicated relationships that can make estate planning a challenge. However, with careful consideration and planning, it is possible to create an estate plan that addresses the unique needs of blended families. Here are 5 tips for blended families: 1. […]

Why a Last Will and Testament Does Not Make a Complete Estate Plan

While the Last Will and Testament is an important estate planning tool, Orange County trust and estates lawyers want clients to be aware that there are certain things it won’t accomplish. To start, a Last Will and Testament will only come into effect after you’ve passed away, which means that it cannot be used to […]

Why You Need a Pour-Over With Your Living Trust

I get asked this question a lot: “If I have a trust, do I need a will?” The short answer is: “Yes, you do.” Of course, the next natural question is “why?” To understand the why, it’s helpful to first see the probate problem that can arise even when a Revocable Living Trust is in […]

How a Pour Over Will Works with a Living Trust

While most people have heard of a basic Last Will and Testament, they may not know what a Pour Over Will is and how it works with a Living Trust. As an Orange County will lawyer, I’d like to explain this estate planning tool. Essentially, a Pour-Over Will is used in conjunction with a Living […]

How to “Marie Kondo” Your Financial Life and Streamline Your Estate Planning Process

Listen to the Audio Version If you’re not familiar with Marie Kondo, take some time this week to watch one of her videos on YouTube or check out her new Netflix series, Tidying Up with Marie Kondo. It’s incredible to watch the relief and joy that people experience just by implementing her simple strategies to […]

How Do I Talk to My Elderly Parents About Money Management?

While it may seem straightforward at first, there are a lot of details and difficulties that can get in the way of having the conversation with your aging or elderly parents. There are so many things to coordinate, and often the parent is less than helpful in the process. In this video, Kevin Snyder covers […]