Estate Planning Checklist

Love Much. Dream Big. Plan Well.

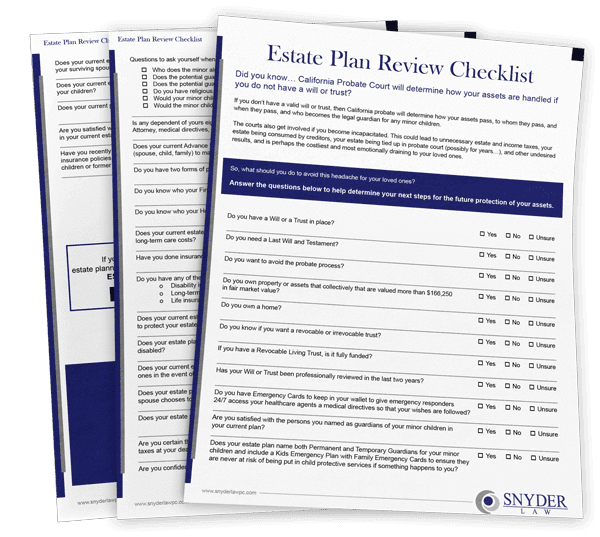

Estate Planning Checklist

An estate plan is about more than tax planning, and you do not to be extremely wealthy to need one. Having a good California estate plan means your assets are safeguarded, inheritances for family are protected, and that the aftermath of dealing with difficult life events will be made easier for your family and friends. There will be no guessing your wishes, less opportunity for conflict, and your affairs will be kept out of court. Learning what legal documents you need or reviewing your current will, trust, and other estate planning documents can go a long way towards ensuring you have the right plan in place.

Our Estate Planning Checklist covers topics such as:

- Do you have a medical emergency protocol in place to alert loved and give care providers immediate access to your important legal and health documents?

- Have you properly designated legal guardians for any minor children to ensure they are never at risk of being put in child protective services if something happens to you?

- Does your current estate plan protect you and your assets from expensive long-term care costs?

- Are you certain that your current estate plan will minimize possible federal and state taxes (estate, capital gains, property) at your death, including taxes on your house, life insurance and IRAs?

- Does your current plan protect your children’s inheritance from a divorcing spouse or possible lawsuits?

These are just a few of the questions a thoughtful and complete estate plan should cover. Download our full checklist to review the rest or call us today at (949) 333-3702 to schedule a meeting.