Trusts are powerful financial tools used to manage and protect assets for individuals and their beneficiaries. They provide a reliable way to safeguard wealth for future generations, manage charitable giving, and protect assets from potential creditors. However, just like any financial arrangement, trusts can become targets for scams and fraud. To ensure your trust remains […]

Archives for October 2023

The Role of Trusts in Asset Protection and Growth

In the world of finance and wealth management, asset allocation is a crucial strategy for achieving long-term financial goals. One powerful tool in asset protection and growth is the use of trusts. Trusts provide a flexible and efficient means to manage assets, protect them from various risks, and optimize investments, especially during market fluctuations. The […]

The Whys and Hows of Talking to Your Kids About Your Estate Plan

Talking about the taboo topics of money and death in one conversation is not most people’s idea of a good time. Many may say that talk of death makes them uncomfortable, and to discuss money would simply be impolite. Yet, when it comes to your family and their future, these connotations should be set aside […]

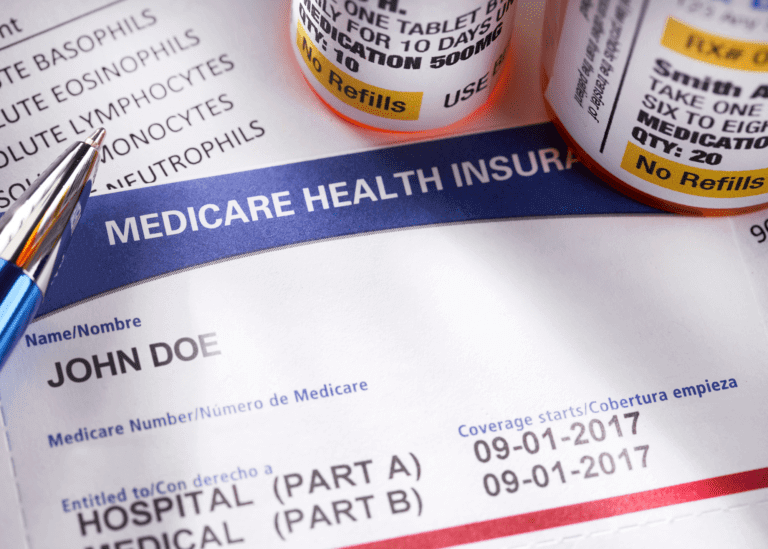

Navigating the Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) is a critical time for Medicare beneficiaries to review and make changes to their healthcare coverage. Whether you’re new to Medicare or have been enrolled for years, understanding the AEP and knowing how to prepare can help you make the best choices for your healthcare needs. What Is the […]

Estate Planning Myths and Misconceptions

Estate planning is a crucial aspect of financial responsibility that often gets overlooked or misunderstood. It’s not just for the wealthy; it’s for everyone who wants to ensure that their assets are distributed according to their wishes after they pass away. Unfortunately, there are several myths and misconceptions surrounding estate planning that can lead to […]

Securing Your Legacy

Every year, during the third week of October, we observe Estate Planning Awareness Week—a time to highlight the importance of planning for the future and securing your legacy. While discussing topics like wills, trusts, and inheritances may not be the most exciting conversation, they are undeniably essential for the financial well-being of your loved ones […]

Avoid the Fright of Unpreparedness This Halloween!

As Halloween approaches, and the air becomes chillier, our thoughts often turn to ghosts, goblins, and all things eerie. But there’s something even scarier than the spookiest haunted house—a poorly planned estate! Just like a good Halloween costume, a well-thought-out estate plan can disguise your assets and protect your loved ones from financial frights. 1. […]

Take Time for Yourself

Being your best starts with taking care of you. However, in the midst of busy schedules, it can sometimes take a backseat. Yes, we ALL are overly busy. Whether you are a parent of young children, business owner, or a retiree (indeed our retired clients often say that they are busier in retirement than they’ve […]